News and Stories

Every community has a story

Rural advocates, thought leaders, students and community builders are leading our region toward a stronger, more inclusive future for children and their families. Read their stories here. Looking for Foundation news? See our latest press releases.

OR

Supporting families, preventing harm

Last month, we celebrated Child Abuse Prevention Month — a powerful reminder of our shared responsibility to keep kids safe, especially in rural communities across Oregon where resources can be limited and families face unique challenges.

The backbone of rural Oregon’s economy

Launched in 2021, GRO currently supports four rural communities to build a network — a community ecosystem — that wraps around in support of local entrepreneurs. Find inspiration for ways to support small business in your community from these standout examples.

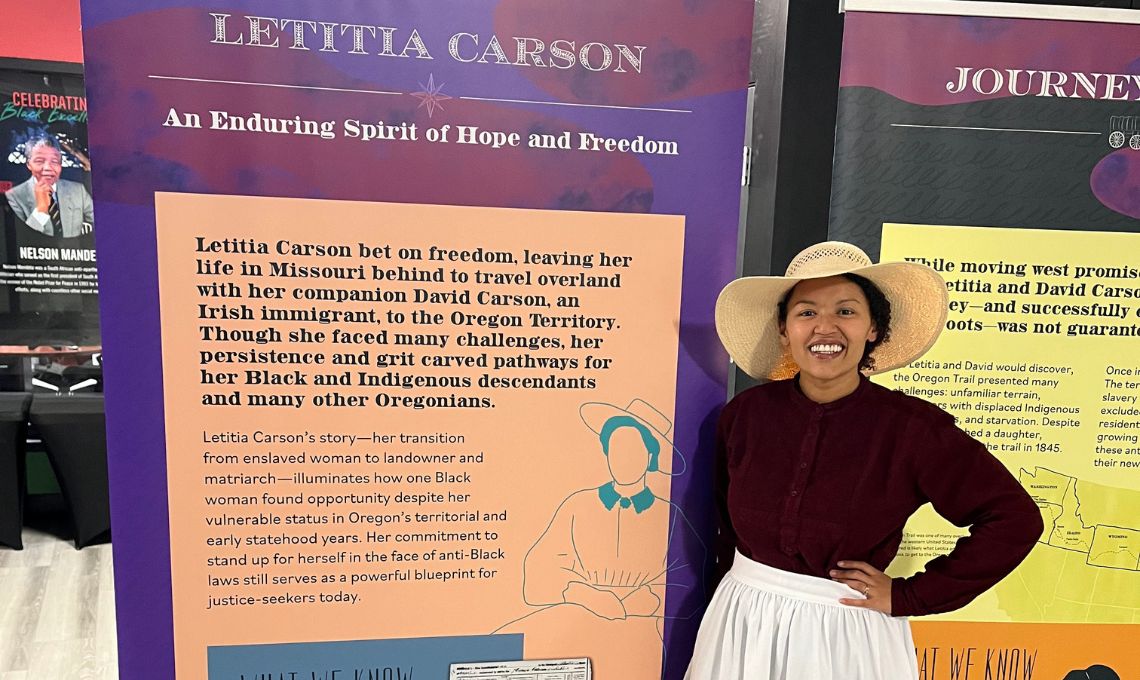

Telling her story

There is little chance now that Black settler Letitia Carson’s story will recede from memory. Her story is one of resilience, persistence and triumph. One of Carson’s most memorable claims to history is as an early Black homesteader in two Oregon locations.

Exploring trends on boys and men

Richard Reeves, author of “Of Boys and Men: Why the Modern Male Is Struggling, Why It Matters, and What to Do About It”, talked about declining male enrollment and other complex and concerning trends before a packed auditorium at Umpqua Community College.

Alumni build bridges to higher education

The Alumni Ambassador program has grown in recent years, as ambassadors are carefully chosen to represent priority demographics. Their expertise helps surmount language, geographic, gender and other barriers as they seek out and engage with potential scholars.

A passion for education for seven generations

We’re thrilled to introduce Christi Boyter as the new Alumni Engagement Coordinator at The Ford Family Foundation! With a wealth of experience in education, Christi is perfectly suited for this role.

Reviews of our SelectBooks children’s collection

Lindsey Frazier and Emily Harger of A Home Away from Home, a licensed child care center in Douglas County, took time to review our SelectBooks children’s collection.

Bringing rural voice to the table

Veteran policy strategist Tim Inman joins the Foundation as its first Chief Policy and Public Affairs Officer. Tim will support policy agenda development and implementation, as well as external engagement and communications.

Butte Valley’s next generation of leaders support their youngest neighbors

Like many of her friends in the Butte Valley area of northern California, Adriana Ramirez used to spend her summers indoors, taking care of her siblings while her hardworking parents spent long days doing farm work.

Voices on Oregon’s child care situation

An issue brief on the state of child care in Oregon comes to a conclusion that will not be a surprise to working families with children: Child care services are expensive and hard to find.

Subscribe to Foundation

News and Stories